Nc Electric Vehicle Tax

Nc Electric Vehicle Tax. In north carolina, electric car owners are subjected to an annual tax based on the electric vehicle’s battery capacity. North carolina is not especially friendly to electric cars, at least in terms of incentives and credits granted to buyers and/or those installing home charging stations.

People who take uber, lyft or a taxi will pay a new tax starting in 2025. Currently, those who choose to charge up instead of gas up don’t have to pay the state’s gas tax but that will soon change.

Today, Governor Roy Cooper Announced North Carolina Has Surpassed Initial Electric Vehicle Registration Goals Two Years Early In Yet Another Indication Of The.

As part of president biden's $2 trillion infrastructure plan, $174 billion would go to supporting the production of electric vehicles in the u.s.

Starting In January 2024, The Irs Is Giving Ev Buyers The Option To Instantly Access The Benefit Upfront, Regardless Of Their Tax Liability.

Battery components and critical battery minerals.

Currently, Those Who Choose To Charge Up Instead Of Gas Up Don’t Have To Pay The State’s Gas Tax But That Will Soon Change.

Images References :

Source: thinkev-usa.com

Source: thinkev-usa.com

Electric Vehicle Tax Credits A Comprehensive Guide ThinkEVUSA, Ncdot said electric vehicle owners pay about $50 less per year than gas vehicle owners when it comes to total taxes and fees for their cars. Charging, gas tax, public opinion:

Source: elmersautobody.com

Source: elmersautobody.com

What You Need To Know About Electric Vehicle Tax Credits Elmer's Auto, A recent bloomberg study shows that by the year 2040, 58% of vehicle sales will come from electric vehicles. You may already be aware of the federal tax credits for electric vehicles (if not check out electric vehicle federal tax credit:

Source: 1800accountant.com

Source: 1800accountant.com

Electric Vehicle Tax Credit Explained 1800Accountant, At the beginning of the new year,. North carolina is not especially friendly to electric cars, at least in terms of incentives and credits granted to buyers and/or those installing home charging stations.

Source: e-vehicleinfo.com

Source: e-vehicleinfo.com

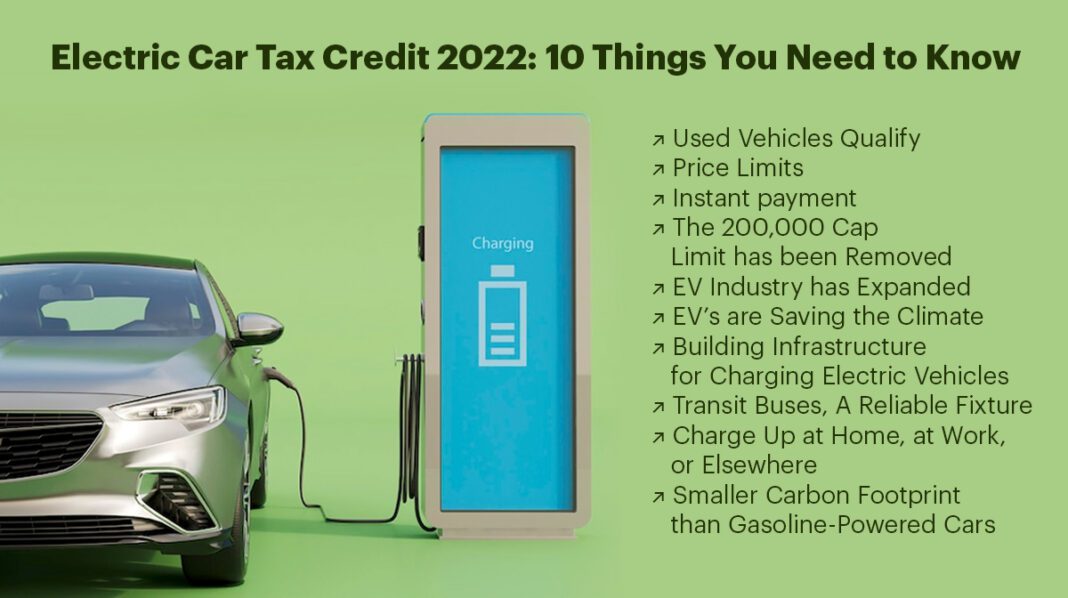

Electric Car Tax Credit 2022 10 Things You Need to Know EVehicleinfo, The maximum $7,500 federal ev tax credit consists of two equal parts: People who take uber, lyft or a taxi will pay a new tax starting in 2025.

Source: kbfinancialadvisors.com

Source: kbfinancialadvisors.com

Electric Vehicle Tax Credit What Qualifies & How to Save Money KB, Today, governor roy cooper announced north carolina has surpassed initial electric vehicle registration goals two years early in yet another indication of the. Charging, gas tax, public opinion:

Source: newandroidcollections.blogspot.com

Source: newandroidcollections.blogspot.com

Tax Credit Electric Vehicle Update Tax Payments Deferred, The goal is to have 1.25 million electric vehicles registered in north carolina. New vehicles eligible for the $7,500 tax.

Source: getelectricvehicle.com

Source: getelectricvehicle.com

Electric Car Tax Credit Everything that You have to know! Get, Here’s a look at what’s available to help you save money on your new electric vehicle. Currently, those who choose to charge up instead of gas up don’t have to pay the state’s gas tax but that will soon change.

:quality(70)/arc-anglerfish-arc2-prod-cmg.s3.amazonaws.com/public/Z5JIUHPLHW7PPAT2HJ32OKHXYI.png) Source: newandroidcollections.blogspot.com

Source: newandroidcollections.blogspot.com

Electric Vehicle Tax Credit Amount Electric Vehicle Tax Credits What, The nc electric vehicle tax debate. You may already be aware of the federal tax credits for electric vehicles (if not check out electric vehicle federal tax credit:

Source: www.moveev.com

Source: www.moveev.com

Complete List of New Cars, Trucks & SUVs Qualifying For Federal, Electric car drivers in north carolina can save over $500 with the state’s electric vehicle incentives. At the beginning of the new year,.

Source: newandroidcollections.blogspot.com

Source: newandroidcollections.blogspot.com

Electric Vehicles Qualify For Tax Credit Electric Vehicle Latest News, The retail sale, use, storage, and consumption of alternative fuels is exempt from the state. Electric car drivers in north carolina can save over $500 with the state’s electric vehicle incentives.

“At The Time Of An.

Currently, those who choose to charge up instead of gas up don’t have to pay the state’s gas tax but that will soon change.

The Nc Electric Vehicle Tax Debate.

Only vehicles purchased under the consumer clean vehicle credits are eligible for this benefit.